Xero vs MYOB: Which Bookkeeping Software Is Best for Australian Small Businesses in 2025?

Choosing the right software today can save time, stress and money, as well as help your business grow. This guide compares Xero and MYOB feature‑by‑feature, shares real‑user insights, and recommends the best fit, plus industry‑specific suggestions and Australian context.

Quick Comparison Table

| Feature | Xero | MYOB |

|---|---|---|

| Cloud-Based |  True cloud (all plans) True cloud (all plans) |  Cloud available; some desktop-only versions Cloud available; some desktop-only versions |

| Mobile App |  All-in-one app for invoices, receipts, reconciliation All-in-one app for invoices, receipts, reconciliation |  Separate apps (Capture, Invoice, Team) Separate apps (Capture, Invoice, Team) |

| Ease of Use |     (intuitive for non-accountants) (intuitive for non-accountants) |   (better for experienced users) (better for experienced users) |

| Bank Feeds | Unlimited bank connections, automatic reconciliation | Lite plan limited to 2; higher tiers unlimited |

| Payroll | Built-in up to 200 employees (depends on plan) | Unlimited employees on Pro/AccountRight |

| Inventory | Basic built-in; robust via 1,000+ apps | Advanced built-in features (AccountRight) |

| Reporting | Customisable, multiple reports at once | More limited; often one at a time |

| Support | Online docs and community only | Business-day phone + online support |

| Onboarding | Self-guided setup (with add-ons) | Desktop may require installation assistance |

| *Starting Price (AUD incl GST) | ~$32/mo | ~$30/mo (but features vary) |

| Best For | Busy small business owners, Xero-savvy advisors | Payroll-heavy, inventory-intensive businesses |

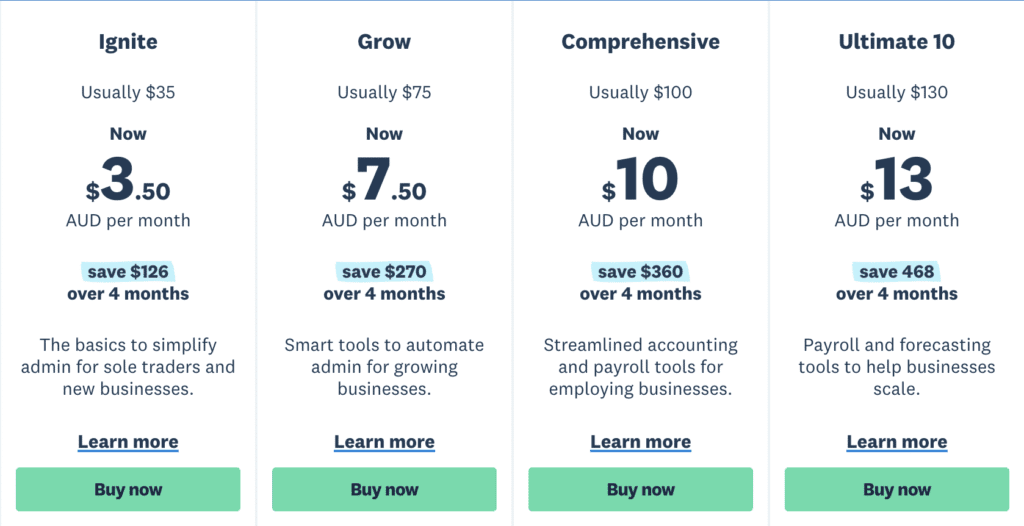

Xero Pricing (updated 25th July 2025)

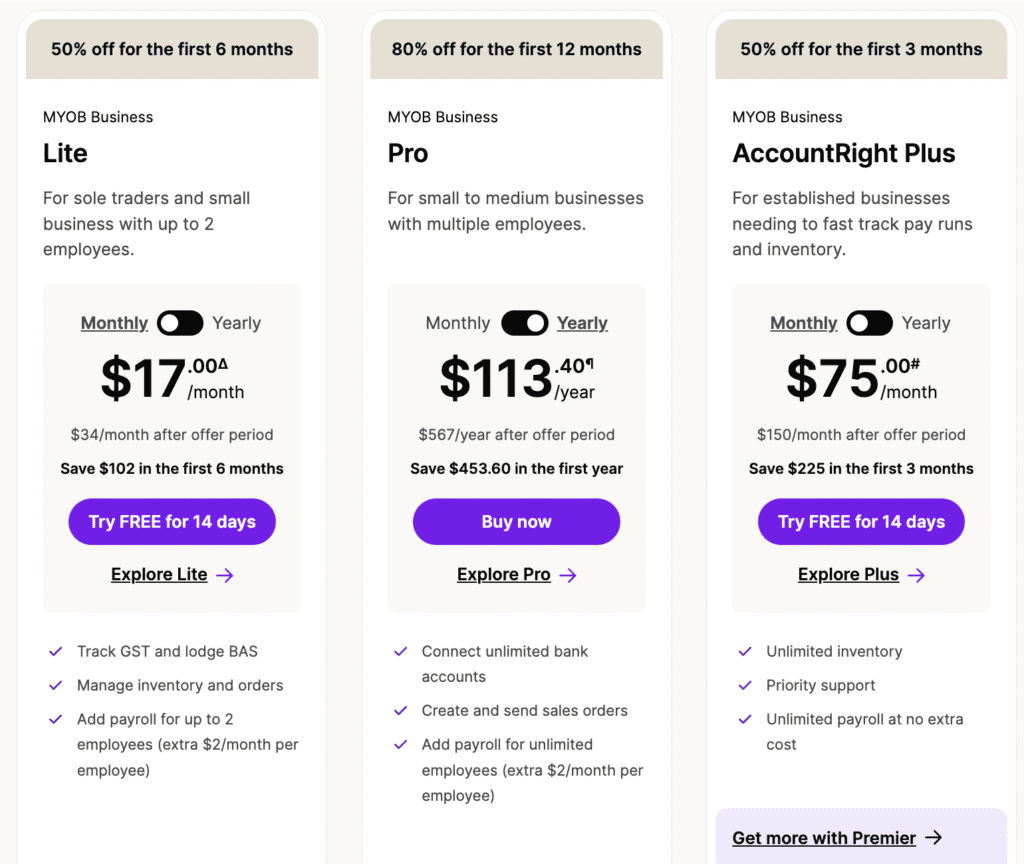

MYOB Pricing (updated 25th July 2025)

1. What Is Xero? What Is MYOB?

Xero Limited, founded in New Zealand in 2006, now serves over 180 countries and has more than 60% of the Australian cloud accounting market

MYOB (Mind Your Own Business), established in Australia in the early 1980s and now owned by KKR, offers both cloud and desktop products with strong local support

2. Pros & Cons: What Users and Experts Say

Xero Pros

Highly user-friendly—ideal for non-accountants and business owners handling their own bookkeeping.

Strong automation: unlimited bank feeds, auto-categorisation, batch reconciliation.

Huge app ecosystem: over 1,000 integrations, including major e‑commerce, payment and job‑tracking tools

Popular with accountants: many firms prefer or require Xero clients

Frequently highlighted in user comments:

“Xero is the gold standard… MYOB stayed in the dinosaur era”

“Most people are going to recommend Xero … it’s still worth the man hours it saves.” .

Xero Cons

Pricing increases have frustrated loyal clients.

Inventory capabilities need third-party tools for advanced use.

Support issues: some users report slow response or limited phone support.

MYOB Pros

Offers unlimited payroll and advanced inventory in higher-tier plans.

Phone support available, helpful for direct assistance.

Desktop option still useful for firms with hybrid workflows or legacy files.

Recently rebranded to modernise as a full‑cloud SaaS platform tailored to Australian SMEs

MYOB Cons

Steeper learning curve; interface can feel dated.

Fewer app integrations compared to Xero.

Bank feed limits in Lite plans, limited customisation in reports.

Manual end-of-year rollover required in desktop/AccountRight versions.

3. What Real People are saying

Real-world users on Reddit and discussion boards share telling insights:

“Xero is king.… MYOB stayed in the dinosaur era.”

“Xero saves man hours, even with price increases.”

“Xero’s client base and advisor support is huge in Australia.”

Emerging alternatives like Reckon, Zoho, and Thriday show up in comments as low-cost or niche options, but most users noted limited features or inconsistent support.

4. Choose Based on Your Business Needs

If you’re just starting out or using pen & paper/Excel:

Go with Xero — it’s quick to learn, flexible, and widely supported by advisors. You’ll save hours and can scale easily.

If payroll and inventory are core to your business:

MYOB may suit better, especially for growing teams or retail/trade businesses needing robust stock control and award payroll.

If you need mobile invoicing, cloud access anytime:

Xero’s all-in-one mobile app handles invoices, reconciliation, quotes, and receipts. MYOB splits features across multiple apps.

If your accountant/bookkeeper has a preference:

Work with them if they’re experienced in one platform, they can help you implement and optimise quicker.

5. Industry Match: Who Should Use What?

| Business Type | Recommended Software |

|---|---|

| Sole traders, freelancers | Xero |

| Start-ups, service businesses | Xero |

| Trades with inventory (multi-location) | MYOB AccountRight |

| Businesses with > 200 employees | MYOB Ultimate |

| Clients with advisor-guided implementation | Xero or MYOB depending on advisor preference |

6. Expert Insight from Bookkeeping Angels

“At Bookkeeping Angels, we work with both Xero and MYOB every day. For clearer cash flow visibility, automation, and an app‑based workflow, Xero is the winner for most Australian small businesses. But we also implement MYOB for businesses needing advanced payroll or built-in inventory—especially where staff already rely on it. Ultimately, it’s about choosing what suits your workflow, not just what’s trending.”

7. FAQs

Is Xero easier to use than MYOB?

Yes—beginners find Xero more intuitive, with clearer menus and workflows.

Can I switch from MYOB to Xero easily?

Yes, you can migrate key data (contacts, chart of accounts, transactions), though clean‑up work may be necessary

Which is cheaper in the long term?

Starter tiers similar in price (~$30‑$35), but additional payroll or advanced feature costs may tilt in favour of Xero’s flat pricing unless you need MYOB’s built-in inventory.

Does Xero integrate with ATO and bank feeds?

Absolutely—Xero provides seamless Single Touch Payroll and GST reporting, and connects with most Australian banks and financial services

8. Final Verdict

For 80–90% of Australian small businesses, Xero is the best value:

Modern, cloud-based

Easy to learn

Fast to implement

Broad integrations

Trusted by advisors

MYOB remains relevant for:

Complex payroll scenarios

Retail/trade businesses with inventory across locations

Those preferring phone support or legacy desktop setups

Need help? Book a free consult with Bookkeeping Angels and get a tailored recommendation based on your workflow, business type, and growth plans.

9. Your Next Steps

Try both platforms with a 30-day free trial.

Book a free strategy session with Bookkeeping Angels—no push, just professional advice.